What is reputational risk?

By definition, reputational risk refers to the potential for negative publicity, public perception or uncontrollable events to have an adverse impact on a company’s reputation, thereby affecting its revenue.

Reputational risk strikes without warning and shifts your corporate landscape. Even worse, it injects an unfavorable narrative into your search results which affects customer opinions and impacts revenue. There are countless statistics about online reputation that support this conclusion. We commissioned a study by Forrester Consulting to find out what executives at large brands think about SEO strategy and reputation.

- 43% of executives think removing unwanted search results would increase sales

- 43% of brands believe improving search results would increase conversion rates

- 42% of brands say search results are tied to lead generation

- 38% of brands believe minimizing unfavorable search results would improve close rates

54% of executives believe reducing unfavorable search results would drive revenue growth

Reputation risk vs strategic risk

Unfortunately, reputational risk is often neglected or confused with other types of corporate risk. Let’s look at how they all relate to one another.

Strategic risk is specific, measurable and predictable. Therefore it is controllable.

Reputation risk, on the other hand, is largely unpredictable. In fact, it can even be tied to events that aren’t your company’s fault. Still, opinions of clients, investors, business partners and the general public can have a profound impact on your firm’s revenue. Therefore, it’s critical to be aware of hazards that result in reputational damage to a business.

Types and causes of reputational risk

There are numerous types of risk to guard against, including outside adverse events, workplace practices, data retention failures, product recalls, bad financial statements, and CEO reputation issues. Let’s dive into the scenarios that pose the greatest threat.

CEOs, company leadership and employees

If your CEO has a negative reputation, then so does your company. And that, ultimately, affects revenue, investments and shareholder value. That’s because a CEO’s reputation cannot be separated from that of the company, and vice versa.

Executives attribute 45% of their company’s reputation to the CEO’s reputation

25% of a company’s market value is directly attributable to its reputation

Even if a beleaguered CEO leaves the company, his or her reputation may continue to damage the brand. That can make it difficult and expensive to find a replacement, and could further feed the negative news cycle.

Company leaders aren’t the sole source of reputational risk; any of your employees could spark public outrage. Imagine the consequences in each of the following scenarios:

- A bank teller or branch manager calls the police for racially motivated reasons

- One of your wealth managers refuses to serve a gay couple

- A director at your VC firm is accused of sexual misconduct

Any of those situations could cause a viral news cycle that results in boycotts, customer defection, and significant revenue loss for years.

Negative articles

Company layoffs, lawsuits, scandals and regulatory penalties can impact revenue for years if you don’t remove those articles from your Google search results. Whether brought on by unsettled employee disputes, customer complaints or regulation violations, negative media attention can shackle profits for global banks, financial services companies and other businesses.

According to a new commissioned study by Forrester Consulting, 42% of brands believe reducing unfavorable search results would improve lead generation. Moreover, 54% of executives believe improving search results would drive revenue growth. Read the full study here.

Furthermore, sometimes good business decisions don’t sit well with employees or the press. Events like mergers and acquisitions or closing down an underperforming factory could trigger negative articles that damage your reputation.

Maybe an old article won’t go away. Or perhaps something from the past resurfaced. Whatever it is, we can help mitigate your brand’s reputational risk.

Let’s discuss how much a negative reputation is costing your brand. Contact us to set up a call.

Social media

Social media can be both a cause and a catalyst for a negative reputation. When company leaders post controversial comments online, their statements affect the entire business, not just the executive’s reputation.

Additionally, unsolicited brand mentions by influential political figures or celebrities can also lead to social media backlash. Although your company may have been casually mentioned, the public will likely infer a reciprocal endorsement.

Furthermore, social networks can amplify negative press that may otherwise have gone unnoticed.

Services and pricing

Whatever your business model, if your company underperforms or overcharges, it will eventually develop a bad reputation. For example, a journalist may publish an expose about shady sales techniques or reveal hidden fees. Or a financial analyst could write a damaging article about the quality of your investment funds.

Data loss

Your customers trust you with their data. In fact, finance companies handle some of the most sensitive personal information, including: names, social security numbers, passwords, logins, pin numbers and bank account numbers. A data breach will corrode your institution’s reputation and could cost you hundreds of millions of dollars.

Regulation changes

Government regulations can change with each election cycle. Under one administration your bank may meet stress test requirements, and under another you could face liquidity risk. When the public thinks your financial institution is unstable, they’ll take their money to your competitors.

Reputational damage

Your business’s reputation is your most valuable asset, especially if you’re a bank or financial institution.

A negative corporate reputation harms client and investor trust, erodes your customer base and hinders sales. A poor reputation also correlates with increased costs for hiring and retention which degrades operating margins and prevents higher returns.

Furthermore, reputational damage increases liquidity risk which impacts stock price and ultimately slashes market capitalization.

Reputational risk examples for banks

Wells Fargo is probably the best example of the impact of reputational risk. The bank’s employees opened millions of fake accounts, overcharged for mortgage insurance, signed up customers for unnecessary car and pet insurance and accidentally foreclosed on hundreds of homes.

Those actions prompted the bank to take the following actions to mitigate reputational risk:

- Fired 5,300 workers

- Replaced longtime CEO

- Replaced board chairman and directors

- Paid $185 million to atone for shady sales practices

- Reserved $285 million to refund wealth-management clients for pricing and fees

“There’s no question that Wells Fargo’s scandals are responsible for seriously eroding shareholder value.”

William Klepper, management professor at Columbia Business School

As a result, the wealth and investment management unit has struggled to generate new business. The Federal Reserve also limited Wells Fargo’s growth until the bank changes its management and risk control procedures.

These incidents, coupled with the soured reputation of the former CEO, have created a substantially negative online presence that’s hyper-saturated with bad press. If Wells Fargo wants to recover their damaged reputation, they’ll need to make a significant investment in enterprise-level reputation management

Next, let’s look at some reputation risk management best practices.

Four steps of reputation risk management

It’s important to develop a framework for managing reputational risk prior to an issue. The following steps will help you measure, monitor, manage and mitigate damage to your reputation.

1. Measuring reputational risk

Step one is to execute a reputational risk assessment to establish the baseline for your company’s image. That will help you determine public perception of your company and competitors as well as the industry in which you operate.

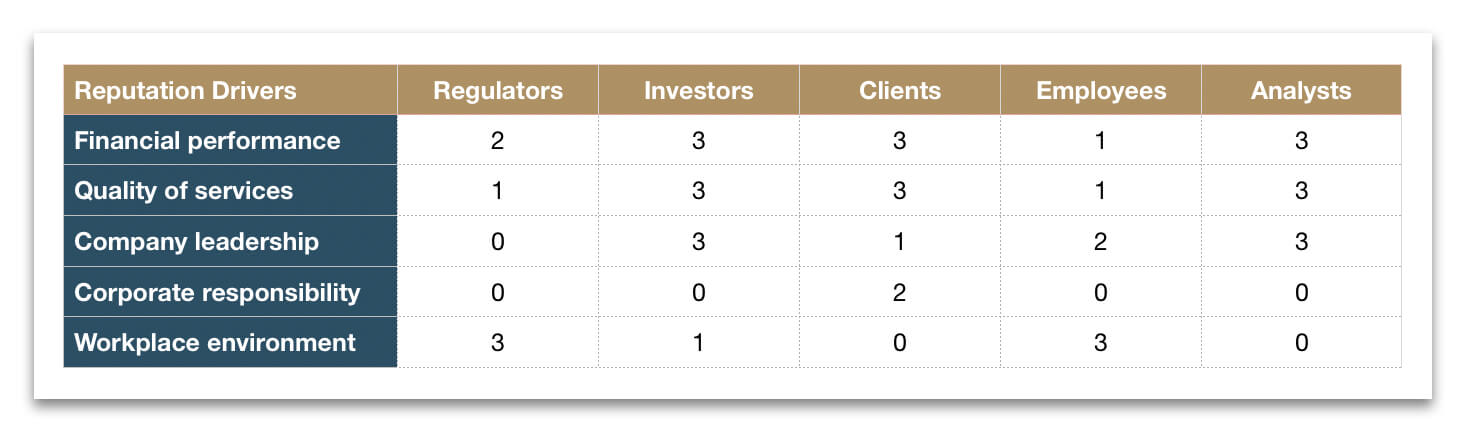

Reputational risk is highly subjective. So, segment your stakeholders into separate groups to determine areas of exposure. You may want to include regulators, analysts, investors, clients or employees.

Next, indicate the level of danger for each segment. For example, you may use a numeric scale or colors. See the reputational risk assessment template below:

Finally, take inventory of each groups’ perception of your company. This can be accomplished through internal and external surveys or search engines. All media outlets worth their salt have an online presence. So, search engines are incredibly useful reputational risk assessment tools.

However, brand sentiment analysis isn’t as easy as popping your organization’s name into Google. You’ll need to analyze discussion topic density within Google’s index to determine the underlying drivers of unfavorable content. Then, you can set goals around diluting those narratives.

It’s best to enlist the help of online reputation management services like our company to help you quantify and mitigate reputational risk. We mine insights from hundreds of listings in your search results to inform our strategy. Then, we develop a roadmap to naturally inject favorable, forward thinking discussion topics about your brand into Google’s index. This desaturates unfavorable narratives and allows more evergreen assets to anchor your search landscape.

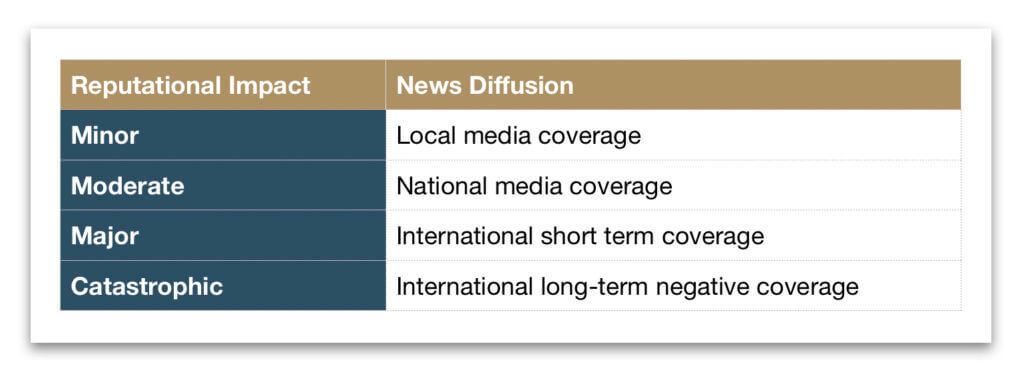

If you want to attempt things yourself, use a reputational risk assessment matrix like the one below to designate the severity of all neutral and negative content.

2. Managing reputational risk

Use your assessment as a framework to develop a reputational risk management plan. You may need to create more than one process or strategy depending upon the type of risk your firm is exposed to.

For example, racial discrimination accusations will require a different approach than customer complaints or inappropriate CEO comments on social media.

It’s impossible to offer specific recommendations for this step because there are an infinite number of possibilities. Ultimately, it’s best to work with a crisis management firm or public relations agency to resolve an active crisis as quickly as possible.

Then, invest in a corporate reputation management strategy to restore your search results.

3. Mitigate reputational risk with ORM

Once your situation is under control, you’ll need to mitigate the damage to your brand’s image through online reputation management (ORM). That process involves syncing your company’s online presence with its real-world accomplishments.

However, it’s no small feat to influence a large organization’s Google results. This requires social media management, brand management, content creation, strategic outreach, digital asset creation, and most importantly search engine optimization. I can’t overstate the importance of working with the right reputation management company.

In addition, firms should run marketing campaigns to shift the negative narrative and repair a damaged reputation. Use those campaigns to promote your company’s corporate social responsibility programs (CSR).

4. Monitor your reputation

The final step in a reputational risk management program is to diligently track brand perception against your baseline. Monitor opinions of employees, customers, vendors, shareholders, analysts and activists. Here are just a few ways you can continuously monitor brand reputation:

- Run surveys

- Hire a brand sentiment tracking agency

- Set up Google alerts

- Manually search your brand and your executives Google

- Work with a reputation management company like us

Reputational risk insurance policies

Reputational risk is a massive expense that squeezes your bottom line. What’s worse, it may even go undetected for years. Because it poses such a substantial threat, company’s might consider taking out a reputational risk insurance policy.

While insurance can help pay for the cost of a damaged brand image, it won’t fix the underlying issue. Therefore, is the cost really worth it? Rather than wasting capital on reputation risk insurance, consider strengthening your online presence instead.

Contact us and we’ll develop a plan to manage your reputation and protect your company for the long haul.

Reputation Management Resources

10 Questions to Ask Your ORM Firm

Spot a high-risk ORM firm with these simple questions.

How to Push Down Negative Search Results

Find out how to bury negative search results in Google

Reputation Management Pricing Guide

Find out how reputation management pricing works.